What is a Bank Statement? Uses, Importance, and More

In today’s digital and financial age, managing money is not just about knowing how much you earn and spend. It is also about keeping track of where your money is going and whether everything is happening as expected. One of the most essential documents that help with this process is a bank statement.

Whether you’re an individual keeping track of your salary and expenses, or a business owner reconciling your accounts, the bank statement is a critical financial tool. In this article, we’ll explore in depth what a bank statement is, what it contains, its key uses, how to read one, and how it can help both individuals and businesses manage their finances more effectively.

What is a Bank Statement?

A bank statement is an official summary issued by a bank that outlines all the financial transactions in a bank account over a specific period—typically a month. It records every deposit, withdrawal, bank fee, interest, payment, transfer, and any other activity that occurred in your account during that period.

Bank statements are usually available in both physical (paper) format and digital format (PDF). Most modern banks allow customers to access their statements via online banking platforms.

Key Information Found in a Bank Statement

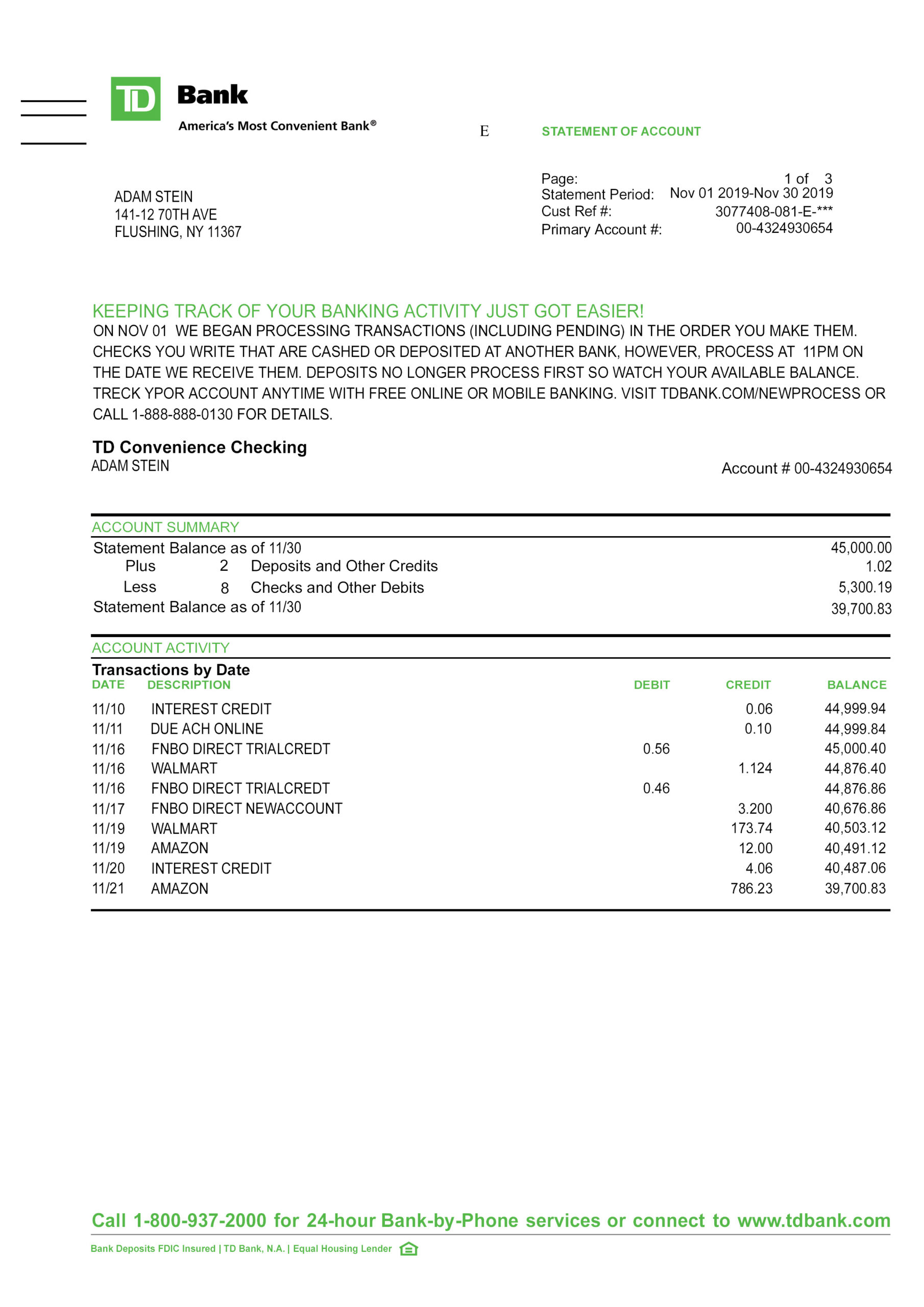

Bank Statement Bank of America Statement

A standard bank statement generally includes the following sections:

- Account Holder Information:

- Name of the account holder

- Address

- Account number

- Name of the account holder

- Statement Period:

- Start and end date of the reporting period

- Start and end date of the reporting period

- Bank Information:

- Bank’s name, address, and contact information

- Bank’s name, address, and contact information

- Opening and Closing Balances:

- The amount in your account at the beginning and end of the period

- The amount in your account at the beginning and end of the period

- List of Transactions:

- Date: When the transaction occurred

- Description: Merchant or type of transaction

- Amount: Money coming in (credits) and going out (debits)

- Balance: Running total after each transaction

- Date: When the transaction occurred

Why is a Bank Statement Important?

A bank statement is much more than a piece of paper or a digital file. It plays a vital role in personal finance, business management, legal processes, and financial transparency. Let’s break down the core reasons why bank statements are important.

1. Tracking Your Spending

One of the most obvious benefits of a bank statement is that it provides a clear record of where your money is going. By reviewing your statement, you can identify unnecessary expenses, habitual overspending, or recurring charges you may have forgotten about (like subscriptions).

2. Verifying Transactions

Bank statements help you confirm whether transactions were correctly processed. If there’s a dispute with a payment, or if you suspect unauthorized activity (such as fraud), the bank statement is your primary proof.

3. Budgeting and Financial Planning

Using the data in your bank statement, you can analyze your income and expenditures over time. This can help you set up a realistic budget, plan savings, and improve your overall financial health.

4. Loan and Credit Applications

Banks and financial institutions typically ask for recent bank statements when you apply for a loan, mortgage, or credit card. Why? Because they want to see your:

- Income consistency

- Spending habits

- Account balance trends

- Debt-to-income ratio

A healthy bank statement increases your chances of loan approval.

5. Proof of Income or Address

If you are a freelancer, self-employed, or don’t have traditional pay stubs, a bank statement can act as proof of income. In many countries, it’s also accepted as proof of address for verification purposes.

6. Business Accounting and Tax Filing

For businesses, bank statements are crucial for:

- Reconciling accounts

- Verifying income and expenses

- Calculating profits or losses

- Preparing for audits

- Filing tax returns accurately

Without access to accurate statements, business accounting becomes unreliable.

How to Read a Bank Statement

Understanding how to read your bank statement is essential to avoid confusion and manage your money better. Here are the key things to look for:

A. Check Your Opening and Closing Balance

- Did the money in your account increase or decrease this month?

- Does the final balance match your expectations?

B. Review Each Transaction

- Ensure you recognise each deposit or withdrawal.

- Look for strange or unexpected charges.

- Pay attention to large transactions or patterns of overspending.

C. Look for Bank Fees

- Monthly maintenance fees

- ATM usage charges

- Overdraft fees

- Foreign transaction charges

Knowing your bank’s fees helps you reduce unnecessary costs.

D. Interest Earned

If you have a savings account, the statement will show the interest earned. This helps you understand the return on your deposits.

How to Get Your Bank Statement

There are several ways to access your bank statement:

- Online Banking:

- Login to your bank’s website or app

- Go to “Statements” or “Documents”

- Download as PDF

- Login to your bank’s website or app

- Email Notifications:

- Some banks automatically email monthly statements

- Some banks automatically email monthly statements

- Physical Mail:

- Traditional banks send printed statements by mail unless you opt out

- Traditional banks send printed statements by mail unless you opt out

- Branch Visit:

- You can request a printed copy from your bank branch (may involve a fee)

- You can request a printed copy from your bank branch (may involve a fee)

How Long Should You Keep Bank Statements?

While many banks keep electronic statements for up to 7 years, it’s wise to download and store your own copies, especially for:

- Tax purposes (keep for at least 3–7 years)

- Proof of payment

- Legal disputes

- Business audits

Digital storage in a secure cloud folder or encrypted hard drive is a safe option.

Are Bank Statements Safe?

Bank statements contain sensitive information. That’s why it’s critical to:

- Avoid sharing them without a valid reason

- Password-protect digital files

- Shred physical copies before discarding

- Use secure internet connections when accessing them online

Common Uses of a Bank Statement in Real Life

Here are real-world scenarios where bank statements are essential:

| Use Case | Description |

| Visa Application | Shows proof of financial stability |

| Rental Agreements | Used as proof of income or address |

| Student Admissions Abroad | Needed for showing financial support |

| Audits & Tax Reviews | Proof of business income and expenses |

| Dispute Resolution | Used to verify or challenge transactions |

| Loan Applications | Banks assess repayment ability via statements |

| Use Case | Description |

| Visa Application | Shows proof of financial stability |

| Rental Agreements | Used as proof of income or address |

| Student Admissions Abroad | Needed for showing financial support |

| Audits & Tax Reviews | Proof of business income and expenses |

| Dispute Resolution | Used to verify or challenge transactions |

| Loan Applications | Banks assess repayment ability via statements |

| Feature | Bank Statement | Transaction History |

| Timeframe | Monthly (fixed) | Custom date range |

| Format | Official PDF | Informal list in app |

| Acceptable for proof | Yes (formal document) | Usually not |

| Contains bank seal? | Yes | No |

A bank statement is more than just a record of transactions—it’s a powerful financial document that helps you stay in control of your money. Whether you’re tracking your budget, applying for a loan, filing taxes, or verifying your income, your bank statement plays a central role in personal and professional financial management.

To make the most of your financial health:

- Check your bank statements regularly

- Understand every entry

- Use them for planning and accountability

In the world of finance, what gets measured gets managed, and your bank statement is the perfect place to start.

We are Also Available Free Download Social security Card Templates, Passports Templates, Drivers license Templates and More